Introduction

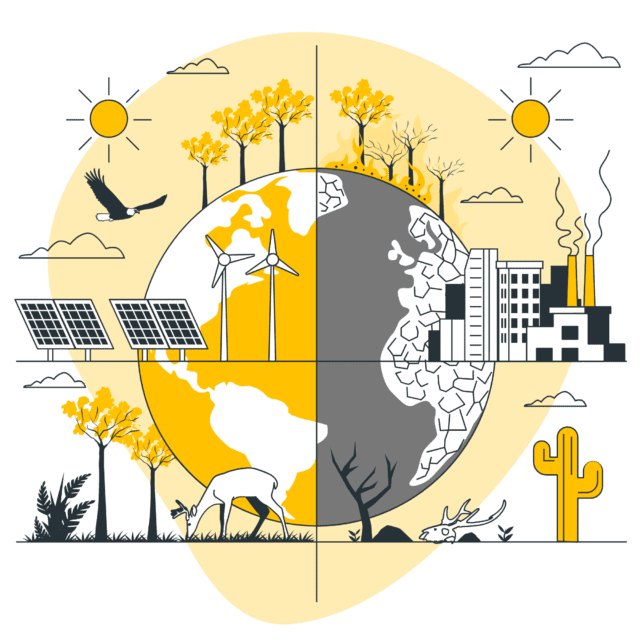

As the impacts of climate change become increasingly evident, the financial sector is waking up to the reality that physical climate risks pose a significant threat to economic stability. Extreme weather events, rising sea levels, and other climate-related phenomena can have profound implications for businesses and economies worldwide. In this blog, we explore the importance of physical climate risk disclosures as a crucial step in preserving our economic stability.

Understanding Physical Climate Risks

Physical climate risks encompass a broad range of potential hazards, including but not limited to hurricanes, floods, droughts, wildfires, and heatwaves. These events have the power to disrupt supply chains, damage infrastructure, and lead to significant financial losses for businesses. Recognizing and understanding these risks is essential for effective risk management and long-term economic resilience.

The Need for Transparency

Physical climate risk disclosures involve companies and financial institutions openly sharing information about how climate change and associated physical risks may impact their operations, assets, and overall financial health. This transparency is critical for several reasons:

-

Informed Decision-Making

- Investors, lenders, and other stakeholders need accurate and comprehensive information to make informed decisions about where to allocate capital. Physical climate risk disclosures provide the necessary data for evaluating a company’s resilience in the face of climate-related challenges.

-

Regulatory Compliance

- Governments and financial regulators worldwide are recognizing the importance of integrating climate risk considerations into the financial sector. Mandatory reporting on physical climate risks is becoming a regulatory norm in many jurisdictions, ensuring that businesses address and disclose these risks responsibly.

-

Long-Term Planning

- Companies that proactively disclose their exposure to physical climate risks are better equipped to develop robust long-term strategies. This includes adopting measures to adapt to changing climatic conditions, fortifying infrastructure, and diversifying supply chains to mitigate potential disruptions.

-

Market Confidence

- Transparent reporting builds trust and confidence among investors and stakeholders. Companies that actively disclose their climate risks demonstrate a commitment to sustainability and resilience, fostering a positive reputation and potentially attracting environmentally conscious investors.

Global Initiatives and Standards

Several global initiatives and frameworks are emerging to standardize physical climate risk disclosures. The Task Force on Climate-related Financial Disclosures (TCFD), for instance, provides a framework for companies to voluntarily disclose climate-related financial information. As more businesses embrace these standards, a common language for assessing and reporting climate risks is established, enhancing comparability and consistency across industries.

Conclusion

Preserving economic stability in the face of climate change requires a collective effort from businesses, investors, regulators, and society at large. Physical climate risk disclosures are not just a regulatory requirement but a strategic imperative for organizations aiming to thrive in a world shaped by climate-related challenges. By openly addressing and managing these risks, businesses can contribute to building a more resilient and sustainable global economy, ensuring a secure future for generations to come. The time to act is now, and transparency is the key to unlocking a climate-resilient economic future.

About us:

We are Timus Consulting Services, a fast-growing, premium Governance, Risk, and compliance (GRC) consulting firm, with a specialization in the GRC implementation, customization, and support.

Our team has consolidated experience of more than 15 years working with financial majors across the globe. Our team is comprised of experienced GRC and technology professionals that have an average of 10 years of experience. Our services include:

- GRC implementation, enhancement, customization, Development / Delivery

- GRC Training

- GRC maintenance, and Support

- GRC staff augmentation

Our team:

Our team (consultants in their previous roles) have worked on some of the major OpenPages projects for fortune 500 clients across the globe. Over the past year, we have experienced rapid growth and as of now we have a team of 15+ experienced and fully certified OpenPages consultants, OpenPages QA and OpenPages lead/architects at all experience levels.

Our key strengths:

Our expertise lies in covering the length and breadth of the IBM OpenPages GRC platform. We specialize in:

- Expert business consulting in GRC domain including use cases like Operational Risk Management, Internal Audit Management, Third party risk management, IT Governance amongst others

- OpenPages GRC platform customization and third-party integration

- Building custom business solutions on OpenPages GRC platform

Connect with us:

Feel free to reach out to us for any of your GRC requirements.

Email: Business@timusconsulting.com

Phone: +91 9665833224

WhatsApp: +44 7424222412

Website: www.Timusconsulting.com